If you’re shipping into the European Union, you can’t afford to ignore TARIC code—short for the Integrated Tariff of the European Communities.

What is a TARIC code, and why should you care?

The TARIC is the European Union’s official customs classification system, designed to unify all trade-related regulations across member states. It builds on the 8-digit Combined Nomenclature (CN) code, which aligns with the Harmonized System (HS). Then, adds two more digits, known as TARIC subheadings, to capture EU-specific measures.

Why the EU TARIC code matters

Suppose you’re importing LED light bulbs from China. The base HS code might be 8539.50. But once you search the TARIC customs code in the official EU database, you’ll likely find an extended code of 8539.5000.80. That final part may apply tariff preferences, require mandatory certifications, or trigger an anti-dumping tax, depending on the product’s specifications and origin.

Understanding the structure of a TARIC code

A complete TARIC customs code contains up to 10 digits, with each layer offering a deeper level of classification:

Example: 6403.59.36.10

Digits 1–2: Chapter – These first two numbers place your product in a broad category. For example, “64” refers to footwear.

Digits 1–4: Heading – This narrows the classification. “6403” covers leather shoes.

Digits 1–6: HS Code – These six digits represent the International Harmonized System, used by over 200 countries. For example, “6403.59” could denote “other leather footwear.”

Digits 7–8: CN Code Extension – This EU-specific layer forms the Combined Nomenclature code. It adds granularity to product types, like differentiating between men’s and women’s shoes.

Digits 9–10: TARIC Subheadings – These final digits introduce TARIC additional codes, which point to applicable EU measures such as tariff quotas or licensing requirements.

Misclassify your goods or skip those last two digits, and you might miss out on a preferential tariff or get hit with unexpected import taxes.

How TARIC code differ from HS code and others

The HS code is the global standard. Developed by the World Customs Organization (WCO), it uses a six-digit format to categorize goods. From there, most countries use the HS as a foundation, then expand on it to meet local trade and customs needs.

So, is a TARIC code the same as an HS code? Not exactly. Think of the HS code as the base and TARIC as the EU’s enhanced version.

Between the two sits the Combined Nomenclature—the EU’s 8-digit system. The first six digits are the HS code, and the next two digits reflect more detailed EU-level product differentiation. The TARIC customs code then adds two more digits for regulatory and fiscal precision.

Meanwhile, the United States uses the HTS code (Harmonized Tariff Schedule), a 10-digit format that also starts with the HS base. The last four digits are unique to U.S. import categorization and are used to assign duties and restrictions.

Quick Example:

- HS code (global): 59 → Leather shoes, other

- CN code (EU): 59.11 → Men’s leather dress shoes

- TARIC code (EU-specific): 59.11.10 → May include anti-dumping duty or licensing

- HTS code (U.S.): 59.90.00 → U.S.-classified leather footwear with its own duty rate

Each country or region uses its version of the customs classification codes to determine import duties, restrictions, and documentation requirements.

How to find the right TARIC customs code for your product

1. Use the official EU TARIC database

The most reliable way to find the correct TARIC customs code is through the EU’s official TARIC consultation tool. This database provides a searchable list of customs classification codes. Simply enter a product name or HS/CN code, and the tool will return matching results with all applicable TARIC subheadings and measures.

2. Know your product details

Get clear on your product’s material, function, use case, and composition. For example, leather vs synthetic footwear may share an HS code but fall under different TARIC additional codes.

3. Ask a customs broker or freight forwarder

When in doubt, consult a licensed customs broker or freight forwarder such as ASLG. They can help you identify the most accurate EU TARIC code, avoid costly mistakes, and ensure regulatory compliance.

How to use EU tariff codes correctly in customs declarations

Once you’ve confirmed the correct TARIC code, here’s how to apply it:

1. Include the TARIC code in the commercial invoice

The commercial invoice is the core document reviewed by customs. Each product line should include:

- Product Description (clear and specific)

- Quantity

- Unit price and total value

- TARIC code (full 10 digits, e.g.,6403.59.11.10)

- Country of origin

Example:

“Men’s leather dress shoes, 100 pairs TARIC: 6403.59.11.10 Origin: Vietnam”2. Declare the TARIC code in the Single Administrative Document (SAD)

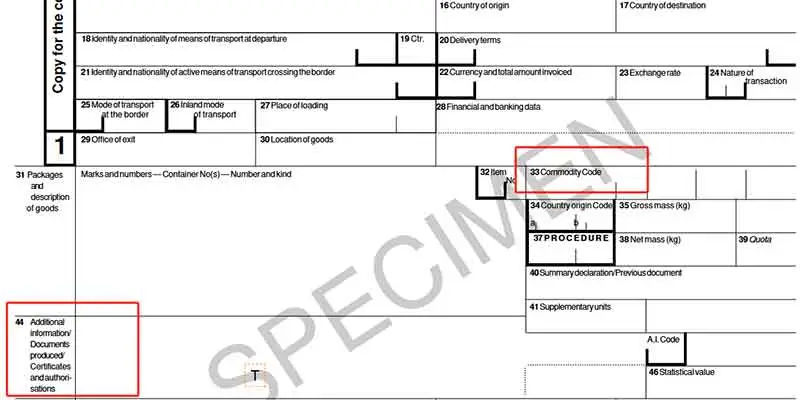

The SAD (Form C88) is the EU’s official customs declaration form. Box 33 is where the TARIC code goes.

Box 33 (Commodity Code): 6403.59.11.10

Box 44 (Licenses or Special Requirements): Add any linked documents such as preference certificates, licenses, or health and safety declarations.

3. Match with EORI & origin declaration

Your EORI number must comply with your import declaration, and the origin of goods must match any TARIC-linked trade agreements. If your product qualifies for preferential tariffs, include the proper statement of origin (e.g., REX, EUR.1, invoice declaration, etc.).

4. Automate it with your forwarder or ERP

If you’re handling large volumes, send the TARIC code to your freight forwarder or integrate it into your ERP inventory system. That way, codes are automatically applied at the production SKU level and carried through to shipping documents.

Conclusion

When shipping to the EU or beyond, accuracy and compliance are non-negotiable. That’s where a trusted logistics partner makes all the difference.

At ASLG, we handle the complexity of customs, so you don’t have to. Our team ensures:

- Your paperwork is complete, compliant, and audit-ready

- Customs clearance is seamless, from tariff checks to license validation

- You avoid penalties, delays, and overpaid duties

Whether you’re a seasoned importer or new to EU tariff codes, ASLG is here to simplify your supply chain.

FAQs

1. Are EU and UK tariff codes the same?

Not exactly. Before Brexit, the UK used the EU TARIC system, but now it maintains its version, called the UK Global Tariff (UKGT). While both start with the HS code as a foundation, UK tariff codes may diverge in the final digits.

2. What happens if you use the wrong TARIC code?

Using the incorrect TARIC customs code can result in underpaid or overpaid duties, customs delays, or even shipment rejections.

3. How to fix a wrong TARIC code after submission?

If you realize a TARIC error after filing, act fast. You can submit a correction request through your customs broker or directly via your local EU customs authority. Supporting documents, such as product specs, datasheets, or invoices, may be required to justify the change.