In 2022, China’s total merchandise exports to the UK will be US$81.54. However, importing from China to UK can be intricate due to customs regulations and compliance requirements.

In this article, we’ll walk you through the essential steps to successfully import from China to the UK, involving duty and tax rules and pre-import considerations.

Table Of Contents

- Get an EORI number when importing from China to UK

- Check the product restriction and import license

- Use the proper commodity code for Chinese imports to UK

- Register with the CHIEF system to declare your goods

- Pay the required import duty from China to UK

- Pay the needed VAT on imports from China to UK

- Include full details on all the invoices and documents

- Product labeling and marking requirements (UKCA)

- Shipping methods and time from China to UK

- Best freight forwarder helps you import from China to UK

Get an EORI number when importing from China to UK

Obtaining an EORI number is fundamental when importing goods from China to the UK. It stands for Economic Operator Registration and Identification Number. This unique identifier is necessary in all customs procedures. It is used to track your imports and exports, ensuring accurate record-keeping.

An EORI number ensures compliance with import regulations and facilitates the accurate assessment of import duties, taxes, and VAT. Applying for an EORI number online is easy and usually takes three working days to receive. The application process is typically done online through the UK government’s official website.

Check the product restriction and import license

You must consider two important factors when dealing with products in China. The first is to check whether your goods can be shipped from China to the UK. Certain items are subject to controls from import into the UK. There are three types you should pay attention to:

Prohibited items: These could include counterfeit goods, such as weapons, illegal drugs, and hazardous materials.

Restricted items: This category could include certain types of food, plants, animals, and chemicals.

Controlled goods: Examples include firearms, pharmaceuticals, certain electronics, and cultural artifacts.

The second is to check whether the goods have the correct certifications and licenses to follow the regulations. If your shipment is under surveillance control, obtain related licenses before importing from China to UK.

For instance, if your Chinese imports are certain healthcare products, you should obtain an MHRA import license. It is used to ensure these items’ effectiveness and safety.

You can check the UK government’s official website or contact relevant authorities to confirm the list of prohibited items and get an import license.

Use the proper commodity code for Chinese imports to UK

A correct commodity code helps classify your goods and determine the applicable customs duties, taxes, and regulations. It is the same as the HS code.

You can visit the UK official Trade Tariff page and use the search function to find the appropriate commodity code for your product.

Ensure that the commodity code you choose accurately represents your product. Otherwise, an incorrect code can lead to failed customs duty payments and even cause shipping delays or fines.

If you’re still unsure, consider seeking advice from Airsupply, an international shipping agent who can help you navigate the complexities of customs classifications.

Register with the CHIEF system to declare your goods

The CHIEF system handles the electronic submission and processing of customs declarations for goods entering or leaving the UK. It helps manage import and export procedures, calculates customs duties, and ensures compliance with regulatory requirements.

In addition, CHIEF can also identify which shipments require inspection of cargo or documentation, allowing faster entry for lower-risk shipments. Whether you or your freight forwarder handles the imported goods, ensure to cover this process.

Pay the required import duty from China to UK

Import duty is a tax levied by a country’s customs authorities on the import process. Once you have obtained the commodity code, you can use it to determine the applicable tariff rate for your goods.

The import duty is calculated as a percentage of the customs value of the goods. The customs value is typically the transaction value, which is the price you pay for the goods plus any additional costs such as shipping, insurance, and handling.

Let’s say you’re importing electronic gadgets into the UK. And the tariff rate is 4.7% for this product’s commodity code.

You purchased the gadgets for $10,000, and the shipping and insurance costs amount to $1,000.

Customs value = $10,000 + $1,000 = $11,000

Import duty = $11,000 x 4.7% = $517

In this example, you should pay an import duty of $517 for the electronic gadgets.

Moreover, the calculation would be more complex if there were preferential trade agreements or additional taxes like VAT. To ensure accuracy, you can rely on Airsupply, who are familiar with all needed duty and tax regulations.

Pay the needed VAT on imports from China to UK

VAT is a consumption tax collected on products whenever value is added at each stage of the supply chain, from production to point of sale.

The standard VAT rate in the UK is usually 20%, but there are also reduced rates (5% or 0%) for certain goods and services. It charges as a percentage of the total value of the goods:

- Purchase price

- Shipping costs

- Insurance cost

- All duty owed

- Other applicable charges like handling fees

Below is an example:

Your cost for your goods is $2000, while the shipping quote is $450. The UK duty rate for these goods is 20%, and the insurance is $50.

The UK duty= 2050×20% = $410

So, VAT= VAT rate of (Duty + Shipping + Insurance + Total Cost of Imported Goods)

= 20% x ($410 + $450 + $50 + $2000)

= $582

If you still suck about how to start, consult with our expert to guarantee accurate compliance with VAT requirements.

Include full details on all the invoices and documents

All labels and invoices you used should contain details of:

- Sender and recipient

- Total Quantity

- Cargo value

- Commodity code

- A full description of your goods

You should print the commercial invoice and do not make any manual changes. Furthermore, you also need to prepare essential documents such as a Bill of Lading, customs declaration (CN22/CN23 Form), etc. Ensure that all the information on these documents is accurate and consistent.

Product labeling and marking requirements (UKCA)

After Brexit, the UKCA marking is the new conformity labeling for products in the UK market. It demonstrates that your product meets UK safety standards and regulations.

The minimum height of the UKCA marking must be 5mm, except when the product is too small. In such cases, the minimum height size can be reduced to 3mm while maintaining proportional readability.

Moreover, you better affix the UKCA label visibly and legibly to your cargo, its packaging, or any accompanying documents. The label must remain intact throughout the product’s lifecycle.

You should follow strict labeling rules to sell goods in the British market. Otherwise, the customs authority may deny your import from China to UK. For more details, you can use this guideline page to see what specific marking rules and regulations apply to the product you want to ship.

Additionally, you can also check our Airsupply team. We will guide you through all necessary documentation and label requirements, guaranteeing a smooth import process.

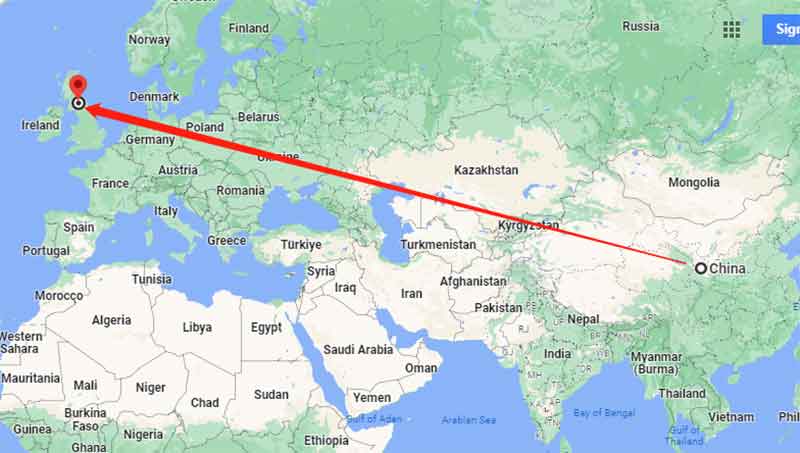

Shipping methods and time from China to UK

Air freight is the fastest, usually taking 3 to 7 days for delivery from China to the UK. However, it is more expensive than other shipping methods due to its speed and convenience. Generally, air shipping is more suited for smaller shipments (weighing under 150kg), valuable items, or those needing expedited delivery.

On the other hand, sea freight presents a cost-effective alternative for goods with larger shipments like clothing or bulk cargo. It takes a more extended transit period, typically 25 to 40 days.

In addition, you can choose rail freight if your shipment is time-sensitive but can tolerate longer shipping times than air freight. It provides a middle ground in terms of delivery time at around 14 to 18 days.

The primary rail shipping route between these two countries is the China-Europe Railway Express. This railway network connects multiple Chinese cities, such as Chongqing and Chengdu, to various European cities, like London.

When selecting a suitable shipping method, you should consider the size and weight of your cargo, which can affect shipping costs and time frames. For example, larger volumes may qualify for reduced rates, especially in sea and rail freight.

Collaborating with Airsupply can help you get customized solutions, secure competitive rates, and ensure an efficient import from China to the UK.

Best freight forwarder helps you import from China to UK

Airsupply, as a top-notch freight forwarder, can streamline the entire shipping process for you when importing goods from China to the UK. They have established connections with reputable carriers and customs brokers endorsed by the UK government. This allows them to make you seamlessly through customs clearance, ensuring your goods navigate border control without a hitch.

Furthermore, Airsupply will stay updated on all pertinent regulations. This means you will not face shipping delays or unexpected hurdles due to non-compliance. Their dedicated customer support is available at every juncture of your China import to UK journey. The ASL team is always on standby to address your inquiries and provide guidance as needed.