A Bill of Entry is a crucial document in the import process, filed by importers or customs agents when goods arrive at a port. Today’s post will explore a Bill of Entry, why it matters, and how it ensures smooth international shipping.

What is a Bill of Entry?

A Bill of Entry (BOE) is a mandatory customs document filed when goods are imported into a country. Whether shipping electronics from China or importing raw materials from an SEZ (Special Economic Zone), this legal form acts as your official declaration to customs. It includes critical details like the cargo description, quantity, value, and purpose, helping authorities assess duties and clear the shipment.

Here’s how Bill of Entry copy distribution typically works:

- Original and duplicate: Submitted to and retained by customs authorities

- Triplicate: Kept by the importer for record-keeping

- Quadruplicate: Sent to the bank involved in processing the payment

Who prepares it:

The importer or their licensed customs clearing agent usually files this BOE document.

When it's required:

A Bill of Entry form must be submitted when goods arrive at a port or airport before customs process the shipment.

Purpose of the Bill of Entry

- Confirm the shipment follows all import regulations and contains no prohibited items.

- Helps customs cross-check export documents and prevent misdeclaration.

- Ensures correct duties are paid and supports claiming Input Tax Credit (ITC).

- Assists in tracking goods, especially in bonded warehouses with deferred tax payments.

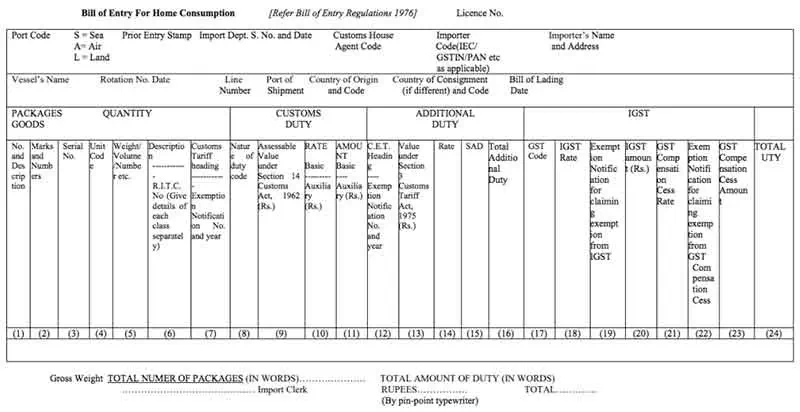

Bill of Entry format and form

The Bill of Entry varies depending on the goods’ nature and the import purpose. Customs authorities classify it into three main types:

1. Bill of Entry for house consumption

Importers use this form when bringing in goods for direct use—either for personal purposes or for internal business operations.

2. Bill of Entry for warehousing (Bond Bill of Entry)

Importers use this version when deferring duty payments. In this case, they store the goods in a bonded warehouse until they pay the required duties.

3. Bill of Entry for Ex-Bond Goods

Used when goods are released from the bonded warehouse, overriding the previous Bill of Entry for Warehousing.

Key components of the Bill of Entry form:

- Importer details: Full name, registered address, and import license information.

- Port and shipment information: Port code, customs agent identifier, and vessel or carrier name.

- Goods specifications: Quantity, declared value, and Harmonized System (HS) code classification.

- Tax and duty details: Goods and Services Tax (GST), Integrated GST (IGST), and applicable customs duties.

- Country details: Country of origin and consignment specifics.

- Authorization signatures: Signatures of the importer and customs agent for document validation.

Country-specific variations:

Each country may apply different requirements to the Bill of Entry format. For instance, in India, importers must include supporting documents such as the Importer Exporter Code (IEC). In contrast, European Union countries often require a Customs Declaration Form to be submitted alongside the BOE.

Bill of Entry example:

Bill of Entry vs. Bill of Lading

A Bill of Lading (B/L) is a shipping contract. It’s issued by the carrier (like Maersk or CMA CGM) to the exporter as proof that the goods have been loaded and are on their way. It outlines who’s shipping what, where it’s going, and under what terms. Without a bill of lading, the cargo doesn’t move.

A Bill of Entry, on the other hand, is a customs declaration. Here’s a quick breakdown:

| Feature | Bill of Lading | Bill of Entry |

|---|---|---|

| Purpose | Proof of shipment and transport contract | Declaration for import customs clearance |

| Filed by | Exporter or freight forwarder | Importer or customs agent |

| Issued by | Shipping line or carrier | Customs department |

| Stage of Trade | Export stage (before shipping) | Import stage (after goods arrive) |

| Legal Role | Acts as a receipt and title document | Enables tax assessment and clearance |

For example, if a company in Germany imports electronics from China, the Chinese exporter submits the Bill of Lading to the shipping line to move the goods. Once the shipment reaches Hamburg, the German importer files the Bill of Entry to declare the cargo and pay the necessary duties.

Before clearing your goods through customs, you should file a Bill of Entry—but the form alone won’t cut it. Customs authorities expect a complete set of supporting documents that verify your shipment’s details and legitimacy. The required paperwork may vary slightly based on the cargo type and the country of import, but here are the essentials:

- Commercial invoice

- Packing list

- Bill of lading or airway bill

- Importer’s declaration

- Insurance certificate

- Bank documents like the Letter of Credit or bank draft

1. Identify the mode of shipment

First, confirm how your goods arrive by air, sea, or courier.

- For air freight, the Air Cargo Complex (ACC) Import Commission manages customs clearance.

- For courier shipments, the New Courier Terminal (NCT) handles processing.

2. File the Bill of Entry Online

Your Customs House Agent (CHA) or customs broker will typically file the bill of entry form electronically via the ICEGATE portal using EDI (Electronic Data Interchange).

3. Register Goods & Pay Duties

After submission, the system generates a unique reference number. The importer or CHA pays applicable customs duties, IGST, or other taxes through the online payment gateway.

4. Customs Review & Final Clearance

Customs will review the documents, inspect the cargo if needed, and issue an Out of Charge (OOC) certificate. It confirms that the goods are cleared for delivery.

Navigating the complexities of import clearance and filing a correct bill of entry can be overwhelming. That’s where Airsupply comes in.

With a global logistics network, ASLG ensures shipments move efficiently across borders. We stay updated with country-specific import regulations, so you don’t have to worry about compliance errors or delays.

Whether you’re a first-time importer or an established global seller, ASLG offers:

- Professional customs handling backed by decades of experience

- In-house documentation specialists to guide your filing

- Real-time updates and end-to-end shipment tracking

- Local expertise + global reach to ensure smooth last-mile delivery