Understanding the current import tax from China to USA can help you prepare for costs and get more seamless shipping. This guide can help you avoid any nasty surprises involving import duties and taxes from China. We’ll be covering the items below:

- What import tax from China to USA needs to pay?

- What product can incur additional tariffs due to monopolies?

- What is the HS code & HTS code? How to check it?

- How to calculate import duty from China to USA?

- How to pay USA import tax from China?

- What situation can exempt duty?

- Is it possible to reduce USA import tax?

- How does ASL help you import to USA from China?

What import tax from China to USA needs to pay?

Whether you’re considering formal or informal entry, the US Customs and Border Protection (CBP) agency is sure to charge some fees. Listed below are some of the taxes and duties you should pay:

Import duty

The rate will vary depending on the imported product and its classification in Harmonized Tariff Schedule (HTS).

Some goods might be subject to higher duties than others. The import duty, also called customs duty or tariff, requests payment when your product’s value is well over 800$. The duty rate can be specific, such as $2.99 per kg.

Or it can be calculated based on the estimated value of the goods, such as 5.4% on $8,000 (the total cargo value). Generally, these rates can range from 0% to several hundred percent of the product’s value.

Merchandising processing fee

It is a user fee to cover the costs associated with processing and clearing customs. Certain goods may be exempt from the MPF, such as goods imported by or for the U.S. government, etc.

Typically, the MPF can be charged $2.00, $6.00, or $9.00 per shipment for informal entry. For formal entry, MPF is calculated at a rate of 0.3464% of the value of the merchandise, with a minimum fee of $27.23 and a maximum fee of $528.33.

Federal Excise Taxe

The Federal Excise Tax (FET) is a tax imposed on specific goods in the USA, such as alcohol, tobacco, motor fuels, firearms, and ammunition. You will not have to pay this fee if your shipment doesn’t include these items. The specific tax rates for these categories can vary and may change over time due to legislative changes.

Harbor maintenance fee

The HMF is a fee charged on maritime cargo shipments that enter U.S. ports. It aims to help fund the maintenance and improvement of harbors and ports. This HMF rate is set at 0.125% of the cargo’s value, with some variations for specific types of cargo. There is a limit of $500 per shipment.

Most of the time, the import tax from China to USA should be general import tariffs plus additional tariffs. The below table shows the prime import taxes you will expect to pay:

| Cargo Value | Shipping Method | Import Tax |

|---|---|---|

| < $800 | Air freight | MPF (informal entry) |

| < $800 | Sea freight | MPF (informal entry) + HMF |

| $800 - $2500 | Air freight | Import Duty + MPF (informal entry) |

| $800 - $2500 | Sea freight | Import Duty + MPF (informal entry) + HMF |

| > $2500 | Air freight | Import Duty + MPF (informal entry) |

| > $2500 | Sea freight | Import Duty + MPF (informal entry) + HMF |

Notice: It is only for general cargo, not including specialist items such as alcohol, tobacco, etc.

What product can incur additional tariffs due to monopolies?

Following former President Donald Trump’s decision to increase tariffs on imports from China to USA, an additional 25% tax might apply to you. This move underwent several stages.

The first phase mainly concentrated on imports valued at over $50 billion. For certain items, like specialized technical equipment for food or textile manufacturing, could be subject to a 25% tariff.

The subsequent phase encompasses a $200 billion list of commodities spanning chemicals, construction materials, food, commercial electronics, and various consumer goods.

For the remainder of Chinese imports, covering valued at more than $300 billion, a 25% duty was initially imposed. However, after the “phase one” agreement signed between China and the USA, these tariffs were down to 7.5%. This category includes:

- Vehicles

- Artwork

- Books

- Weapons

- Waste materials

- Textiles & footwear

- Household electronics

- Precious metals and jewelry

- Chemicals & raw materials

- Toiletries and grooming items

- Food products like dairy, meat, or alcohol

- Animals such as birds or insects

What is the HS code & HTS code? How to check it?

Before you check the import duty rates from China to USA, you should know HS and HTS codes. These are numerical codes used to classify products for international shipping trade.

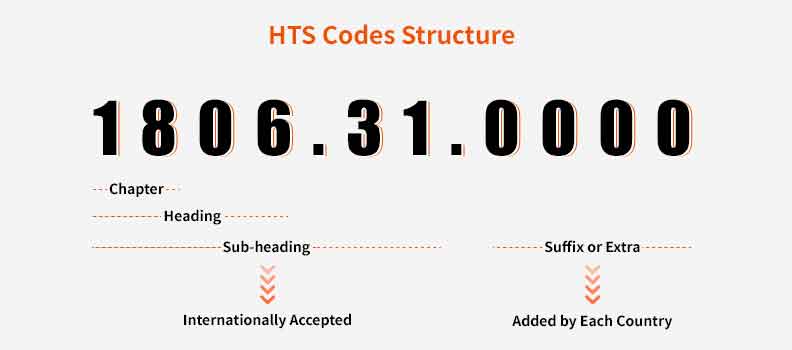

Generally, the HS code is the same internationally, and each one represents a product category. However, the HTS code can have additional digits that are specific to a particular country, such as the USA. Below is an example:

Product: Chocolate BarsHTS Code (USA): 1806.31.0000

18 is the chapter number, which corresponds to “Cocoa and Cocoa Preparations.” It provides a broad category for products related to cocoa.

1806 is the heading number, which refers to “Chocolate and Other Food Preparations Containing Cocoa.”

1806.31 is the subheading number, providing even more specific details about the product. It likely pertains to a particular type or form of chocolate or cocoa preparation.

The last four additional digits (0000)are numbers added by each country to classify subheadings further. It might represent product variations, different packaging, or specific attributes.

How to check?

Check on USITC websites: Many countries have official government websites that provide access to their tariff schedules. For importing to USA, you can visit the USITC to obtain HTS codes with a keyword search.

Search online tools: Various online tools and databases can help you find the appropriate HTS code. Do this by selecting the exact product type in the correct category.

Consult freight forwarder or customs broker: You can always check with your customs broker or freight carrier for an accurate HTS code.

Airsupply, an expert shipping agent, helps you ship from China to USA with the proper HTS code. They also promise seamless customs clearance and delivery in time to meet all your needs.

How to calculate import duty from China to USA?

After determining the correct HTS code for your product and understanding the applicable tariff rates. You can compute the US import tax from China. The following is the basic formula:

Customs duty = total customs value x customs duty rate

MPF fee = cargo value x 0.3464%

HMF fee = cargo value x 0.125%

Utilizing these formulas will assist you in better financial planning for your business. They provide insights into your estimated import costs from China, allowing you to maintain budgetary control.

However, remember that the process can be intricate due to factors like preferential trade agreements, customs valuation methods, etc. You should also notice whether your product needs to pay an additional 25% tariff or potential extra fees.

At Airsupply, they can help you simplify the international shipping process, saving substantial amounts of dollars in costly shipping fees.

How to pay USA import tax from China?

The customs duty is an indirect tax, so you should pay the duty to U.S. Customs and CBP before they release your shipment. You can enlist the services of a licensed customs broker who can manage the payment process on your behalf.

Before proceeding, you need an Employer Identification Number (EIN) or a Social Security Number (SSN). This identifier is crucial for tracking your payment and ensuring proper documentation.

With an accurate import tax amount, you or your chosen customs expert should submit the necessary customs entry forms. And you can pay by Electronic Funds Transfer (EFT), credit card, check, etc.

Once paid, you will receive an Entry Summary (CBP Form 3461) or a similar document. Then, the customs authorities will review your entry and may conduct inspections as needed. Once your shipment receives clearance, it’s ready for final delivery or pickup.

The above is only a general outline of the process, for the specific steps can vary based on the goods types, their value, and applicable regulations. Airsupply, a licensed freight forwarder, is proficient in the various customs regulations, particularly for specialist cargo. They allow you to pass customs clearance seamlessly, ensuring timely delivery.

Sometimes, import tax from China to USA may be an enormous burden. Keep reading to learn how you avoid or reduce tax in business transactions.

What situation can exempt duty?

Import duty-free items: According to CBP, some duty-free products you can bring back to the U.S. without paying taxes. Such as certain types of literature, artwork, and educational materials.

Personal use: Items intended for personal use and not for resale might qualify for duty-free entry. There is a de minimis threshold that shipments with a declared value under $800 might be free from duties. But for alcoholic beverages, cigarettes, cigars, and other tobacco items, it has limits for amount.

Samples delivery: The samples sent for testing might be duty-free. You can ask your supplier to indicate on the Sample Invoice that this item with no commercial value.

Dropshipping: In dropshipping, you usually don’t need to pay USA import duties. It is because the products are shipped directly to customers from a third-party supplier by ePacket or China Post. However, you are still subject to income and sales taxes.

Is it possible to reduce the USA import tax?

According to the above calculating formula, the prime attribute that affects customs duty is the total cargo value you have declared. To bypass formal entry declaration for goods, some importers opt to divide shipments into multiple smaller ones, each valued below $800.

In addition, some people will reduce the product value on the commercial invoice to decrease import taxes from China to the USA. Suppliers may agree and help you to lower the cargo declared value when importing to USA from China.

However, deliberately understating the value may trigger punitive duties imposed by U.S. Customs. Additionally, this action could lead to possible destruction or return to the port of the goods. Considering the potential risks associated with these practices, you better think twice before doing like them.

How does ASL help you import to USA from China?

Airsupply offers one-stop DDP shipping solutions which can help you receive the good at home hassle-free. They can customize the best solution to meet your budgets and requirement.

They match your cargo freight with dedicated services:

- Amazon FBA shipping solutions

- 3000㎡warehousing facilities in America

- Comprehensive shipping term process

- Cargo logistics insurance project

- Proficient dangerous goods shipping