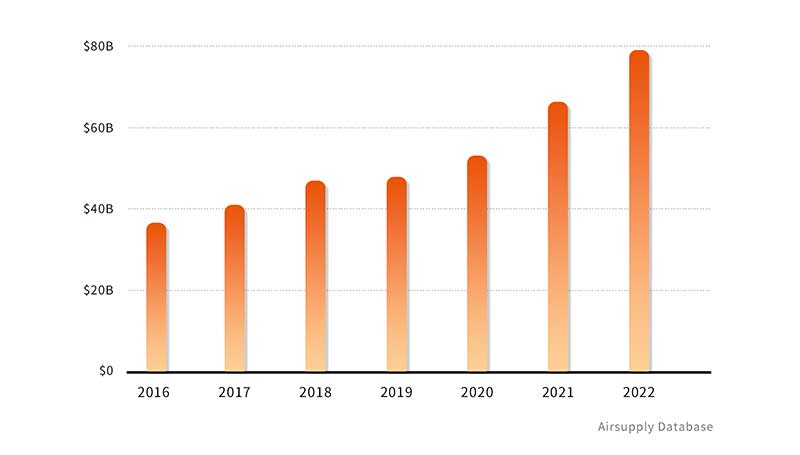

According to the UN Comtrade database, the value of imports from China to Australia amounted to $78.83 billion in 2022. As shown in the chart below, the import data consistently demonstrate a rising trend at an exponential scale.

Importing goods from China to Australia can be one of the most profitable ways of international trade. In this post, we have compiled all the essential information you should know from import documents to duties and more. Keep reading to find out!

Table of Contents

- Understand China-Australia Free Trade Agreement

- Products you can import from China to Australia

- Australian product regulation & safety standard

- Essential China import to Australia documents

- Labeling requirements of import to Australia from China

- Import taxes and charges from China to Australia

- GST on importing goods from China to Australia

- Mistakes to avoid when importing to Australia

- How to find a vetted partner shipping to Australia?

Understand China-Australia Free Trade Agreement

The China-Australia Free Trade Agreement (ChAFTA) is a landmark trade deal signed between China and Australia in December 2015. This agreement aims to strengthen economic ties and promote bilateral trade and investment.

After ChAFTA, tariffs on specific goods are gradually eliminated between China and Australia. Furthermore, it includes provisions to facilitate and protect Foreign Direct Investment (FDI) within the two nations.

You should adhere to the rules and produce a Certificate of Origin to testify the goods are from China. So that you can obtain ChAFTA preferential treatment when importing from China to Australia.

In a nutshell, ChAFTA has fostered closer trade relationships in China and Australia. It can open up new growth opportunities and be an essential driving force for economic growth.

Products you can import from China to Australia

Before embarking on China-to-Australia trade, you can research the Australian market to find which products and services are in high demand. You can also compare market trends to find products that have the potential to perform well.

Below are some best products to import from China to Australia:

- Electrical, electronic equipment

- Machinery, boilers

- Furniture, lighting signs

- Articles of iron or steel

- Toys, games, sports requisites

- Articles of apparel

In addition, you should notice that the Australian government controls what you can and cannot import. There are certain lists of prohibited goods when importing to Australia from China, and you can check them from the ABF website.

However, you may be able to ship some prohibited items to Australia if you have written permission from the Australian government and meet certain conditions. Moreover, you should also check whether the cargo is banned in Australia for product safety reasons.

If you don’t know whether your product is standard for importing to Australia, you can consult an expert shipping agent. They will help you to deliver your cargo smoothly.

Australian product regulation & safety standard

These rules are in place to ensure the safety and quality of goods, protect consumers, and maintain a fair and competitive marketplace.

What is AS/NZS safety standard?

AS/NZS stands for “Australian/New Zealand Standard” and is a set of technical standards jointly developed by Australia and New Zealand. It engages in providing guidelines and specifications for various products, services, and systems to ensure security and good performance.

The AS/NZS standards cover various areas, including electrical safety, product testing, certification, food safety, etc. It applies to and regulates products on the market, and all products generally need to obey if they want to be allowed to place on the market.

Goods that require additional permits when imported from China To Australia

As mentioned above, some goods imported to Australia from China need extra permits based on the regulations. There are strict requirements, especially for importing animals, plants, food, medications, and controlled items,

For instance, due to AS/NZS safety standards, the products which will pose a higher risk to consumers need special documentation, such as firearms and weaponry, chemicals, and tobacco.

When importing products, you should ensure they meet all safety and compliance regulations in Australia. Failing to do so can lead to the product being recalled from the market and cause significant fines for the importer.

Which Australian standards apply to my products?

To determine which standards apply to your products, you need to identify the category or industry that they belong to. Then, you can visit the Product Safety Australia official website to access their online catalog of standards. You will discover all applicable regulations for the product you want to import.

On the other hand, you can also seek advice from a freight forwarder who has rich expertise in importing goods from China to Australia. Like Airsupply, they can lead you to the Australian standards that match your products and ensure the compliance process.

Essential China import to Australia documents

Certificate of Origin

The COO is a document that certifies the origin of manufacturing and shipping of your goods. It is essential for claiming preferential tariff rates under trade agreements like the ChAFTA.

Commercial invoice

This shipping document lays out the product description, quantity, HS code, unit price, total value, etc, for your cargo. It also includes information about the buyer and seller, such as their names, addresses, and contact details. You can also calculate estimated tax and import duties to Australia by the commercial invoice.

Import declaration

It is submitted to the Australian Border Force and offers information about the imported goods, customs value, and other relevant details. The import declaration is crucial for customs clearance, tariff classification, and duties assessment.

Packing declaration

If the packaging materials have wood and straw, they can harbor pests or cause a biosecurity risk as the long transit times by sea freight. The packing declaration helps customs officials identify the materials used for the goods package. And take appropriate quarantine measures if necessary.

Are you looking for more details? Feel free to contact Airsupply to get instant support.

Labeling requirements for importing to Australia from China

When importing from China to Australia, proper labeling ensures the products provide accurate information and adhere to Australian regulations. You must label certain imported goods with a required trade description. It typically indicates how or who manufactures, produces, selects, packages, or prepares the product.

Here are some main labeling requirements to consider:

1. Product labels must be in English or include an English translation. You can add additional languages, but English must be present.

2. The label must show the country of origin, i.e., “Made in China”for products originating from China.

3. It should clearly and accurately describe the imported items. The name and description should match the product’s nature, function, and intended use.

But labeling is not mandatory for all goods imported to Australia from China. You can check the comprehensive list of goods that require labeling provided by the Australian Border Force. If your label has inaccurate or deceptive trade descriptions, it may lead to Australian customs seizing them.

Import taxes and charges from China to Australia

Import taxes are common in cross-border trade. You will be subject to import duties and charges on specific products when importing from China to Australia.

Import processing charge(IPCs)

The Australian Border Force imposes processing charges for each import customs clearance service. This charge varies based on the total customs value of your shipment.

Unlike the tariff rate, the import processing charges are a fixed cost instead of calculated as a percentage of the customs value. It is typically payable by the importer or their authorized customs broker. The IPCs rates were as follows:

For cargo declarations with a customs value between AUD1,000 and AUD10,000, the charge will be:

Electronic declaration: AU$50 Manual declaration: AU$90

For cargo declarations with a customs value of over AUD 10,000, the charge will be:

Electronic declaration: AU$152 Manual declaration: AU$192

But these import processing charges may be updated and changed at any time. It is advisable to check the official ABF website or consult with a customs broker or freight forwarder for the latest price.

Customs import duty

Customs duties are also payable on each shipment imported to Australia. The rate of import duties from China to Australia can vary depending on the good types and their classification under the tariff.

Generally, the tariff rates range from 0% to 10%, but for most products imported to Australia from China, the rate is 5%.

However, some products may be calculated with specific duty rates, while others may be ad valorem duty. You can check the following examples:

Ad valorem duty:

It is charged by a percentage of the goods’ customs value. If the customs value is $1,000, and the ad valorem duty rate is 5%, the duty would be $50 (5% of $1,000).

Specific duty:

It is a fixed amount charged per unit or quantity of imported goods. If the specific duty is $5 per unit, and the total imported units are 1000, the customs duty would be $5,000 (1000 units x $5).

Want to know how much customs duties you should pay for your China to Australia shipment? Click the below button to obtain a live quote now!

GST on importing goods from China to Australia

What is the goods and services tax (GST)?

The goods and services tax is a consumption tax levied on the supply of most goods and services in Australia. This GST is at the rate of 10%. Some products are either exempt from GST or eligible for GST reductions during import, like food items, education-related, and health care.

How to calculate it?

First, you should determine the taxable value of the goods or services. Normally, it would be the sum of:

- The customs value of the imported items

- Payable custom import duty

- Shipping cost for importing to Australia

- Cargo insurance fees (If your shipment has)

Next, calculate the GST amount by applying the GST rate (which is currently 10%) to the taxable value. Below is the practical study:

Customs value = AUD10,000

Customs duty = 5% * AUD10,000 = AUD500

Shipping cost= AUD700

Insurance fee= AUD50

So, the taxable value = 10,000 + 500 + 700+ 50 = AUD11,250

Goods And Service Tax (GST) = 10% * 11,250 = AUD1,125

How to reduce it?

You cannot directly reduce the goods and services tax, but in some ways can affect it. For example, you might pay lower GST by decreasing the quantity of your shipment. Moreover, you also can leverage ocean freight to replace air and consolidate several LCL shipments in one FCL, etc.

Sometimes, the importer will request the carrier to record a value below the actual cost of importing goods from China to Australia. It is an offense to underreport the taxable value of imports. If the Australian Taxation Office spots illegal bids for your imported products, it will lead to severe sanctions.

When do I pay GST on imports from China?

You need to pay the GST amounts to the ABF before the goods pass and release from customs. Payment is usually made electronically through the ABF’s Integrated Cargo System (ICS).

Mistakes to avoid when importing to Australia

Always choose the cheapest options

Sometimes, the cheapest shipping from China to Australia can be enticing. After all, the lower the shipping costs are, the higher the profitability you can get. But for time-sensitive, high-value, or perishable cargo, delivery duration and security should be the top priorities to consider.

Otherwise, you may face significant potential losses during the importation process, such as goods getting damaged or stolen.

Overlooking intellectual property(IP) protection

You better not import counterfeit products which will infringe on the intellectual property rights of others. Furthermore, you can register trademarks and patents to protect your IP before importing.

Miscalculating the margins

Consider all costs involved in China imports to Australia, such as customs duties, GST, freight charges, and other fees. Underestimating the total landed cost can impact your budget and profitability.

Didn't verify shipping provider

Verify the reputation and reliability of your overseas shipping partners. Conduct due diligence to ensure they are legitimate and capable of providing quality logistics services as per your requirements.

How to find a vetted partner shipping to Australia?

To secure the best partner to help you import to Australia from China, you can try to join the trade show. For instance, you can try to participate in Global Freight Forwarder EXPO and Canton Fair, where global businesses will converge.

Additionally, you can browse online marketplaces like Alibaba or official websites to find a reliable freight forwarder. They will place their product lists on that so you can determine which provider aligns with your logistics needs.

Airsupply, a vetted provider by WCA and IATA, can connect your China import to Australia business with famous carriers. They have integrated with ship managers like COSCO, Maersk, OOCL, etc., and hundreds of airlines. For this, Airsupply will support guaranteed cargo space for you even in peak season.

At Airsupply, they have deep knowledge of importing goods to Australia or any country. They also can guide you about the custom duty rates applied to your cargo. Contact and get an online quote now!