First, let’s take a look at the origin stories of these terms. DDP and DDU come from standardized shipping rules, or international commerce terminology, called Incoterms®. Issued by the International Chamber of Commerce (ICC), these international shipping terms are used universally to define the responsibilities of sellers and buyers across international borders.

The terms help buyers and sellers recognize who has what responsibility when it comes to certain costs associated with transporting stuff internationally.

What is DDP?

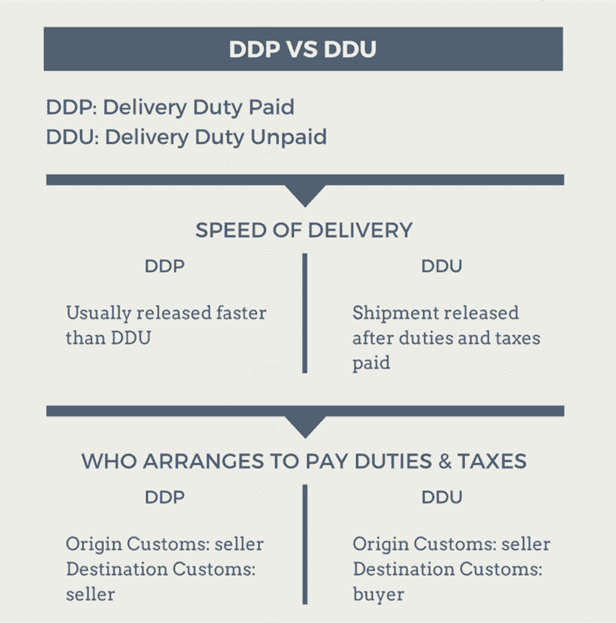

DDP is Delivery Duty Paid. A Delivery Duty Paid agreement means the seller assumes all the responsibility, risk, and costs associated with transporting the goods until the buyer receives them at an agreed destination, which could be a port, fulfillment center, or the buyer’s doorstep.

The buyer and seller agree on all payment details and state the name of the place of delivery before finalising the transaction. The expectation from the buyer is that all DDP costs are included in the final price, with no surprises on the doorstep at delivery.

The seller is responsible for

- Shipping costs

- Export and import duties and licenses

- Customs documentation

- Taxes, including VAT

- Insurance

- Storage costs if there are delays

- Replacement costs if goods are damaged or lost in transit

- Final delivery to the agreed destination

What is DDU?

DDU is Delivery Duty Unpaid. It has been discontinued by the ICC since 2010 but is still widely used. Officially, the ICC has replaced it with the Incoterm® rule DAP, meaning Delivered at Place, but the trade rules are the same as they were for DDU.

DDU means it’s the buyer’s responsibility to pay for any of the destination country’s customs charges, duties, or taxes. These must all be paid for customs to release the shipment after it arrives at a pre-agreed point e.g. Delivered-at-Place, Port of Jebel Ali. The seller takes responsibility until the agreed delivery point, at which stage the buyer becomes responsible.

What is the difference between DDP and DDU?

The pros and cons of DDP and DDU

DDP

Sellers may have more responsibilities under DDP but they also have more control over the process. However, taking all the financial, legal, and bureaucratic responsibility can add significant costs to sellers when things go wrong en route, such as unexpected delays because of port strikes, political unrest, or bad weather.

DDU may appear cheaper at checkout but if customers do not understand that there are additional costs involved, it could prove expensive both for buyer and seller. If the extra charges are unexpected, the customer may not buy from that seller again. Even worse, they may decide not to take delivery at all and the shipment could be abandoned in customs.

Some countries do not allow DDP while others have complicated systems in place. In these markets, sellers may prefer to take a hands-off approach and to leave customs clearance to buyers or their agents with better knowledge of local realities.

The seller may pay DDP costs to take into account unforeseen circumstances and may not use the cheapest logistics partners, leaving the buyer with significant extra charges compared to a DDU delivery.

DDU

This method is potentially cheaper overall for the buyer, with an unpadded checkout price. However, even if the buyer expects to pay duties and taxes, the amount may be difficult to predict and be more than anticipated. Unexpected brokerage, storage, and late payment fees may be incurred.

Which is better: DDP or DDU?

So, which is the better of the two? Should the Delivery Duty Paid (DDP) be used instead of the Delivery Duty Unpaid (DDU)?

Read on to discover which of the two will help further the opportunities your business may have in the international business market.

DDP is costlier

For a business like yours that is looking to cut down on costs, using DDP can be one of the ways to increase your expenses. That is because you, as the seller, will be bearing many of the expenses, such as the duties paid to the customs and other underlying fees.

Besides, the seller tends to pay additional fees when the buyers/receivers fail to come to pick up or claim their goods.

DDU can take buyers unawares

Using the Delivery Duty Unpaid (DDU) can save your business some costs, but it can also have negative impacts on your customer experience.

That is because many customers may not even be aware that there is a customs duty to be paid. So, by the time the customers figure out, it may be late, and they may be short of cash to make the payments.

DDU bolsters shipment abandonment

You have succeeded in reducing your shopping cart abandonment figures by making use of a robust international trade model to get customers to buy from you.

However, if you stick to using the Delivery Duty Unpaid (DDU) model, you tend to trigger an increase in shipment abandonment. It is possible because many customers may be short of cash to pay the customs duty.

Besides, when the customers abandon the shipment, the shipment company/courier tends to return the shipment to you at an additional fee.

DDP increases customer satisfaction

If you can afford to pay the duties, do so because it has a way of increasing your customers’ satisfaction.

As you already know, “a happy customer is a returning customer.”

Tips on communicating the shipment conditions

Because you do not want to take your customers unawares by their responsibility to pay the import customs clearance, you must inform them on time. That will also help you figure out if it is better to continue with the delivery or not.

Some of the channels to communicate the conditions for the shipment include but are not limited to:

- On your page’s FAQ page

- Product pages

- State the shipment conditions in your “Shipping Policy” page

- Email confirmations before shipment

DDP is better

The Delivery Duty Paid (DDP) shipment model is the better of the two. It does not only help to stop taking your customers unaware; it also makes sure that the customers wouldn’t abandon the shipment, thereby forcing you to pay the additional fees for returning the shipment to you.

For the successful implementation of the Delivery Duty Paid (DDP) in cross border trades, we advise that you use the tips above to increase your customer experience.

ASL Can Help with DDP and DDU Shipments

Whether you’re a buyer or seller, it’s important to become aware of the differences between DDP and DDU Incoterms to determine the most cost-effective shipping solutions for your company’s needs. With many similarities but some key differences between a DDP and DDU arrangement, companies will vary in terms of which shipping service is best for their specific business model.

As a trusted third-party logistics service, Airsupply offers cost-effective shipping options for sellers that seek to focus on growing their business with streamlined supply chain management. ASL works with many of the top eCommerce, EDI, ERP, and shipping companies to arrange third-party businesses to outsource their shipping logistics. Get a custom price from Airsupply today to determine if a DDU or DDP shipping service is what your business needs to grow.